The Securities and Exchange Commission has adopted amendments to the disclosure requirements for business acquisitions and dispositions by a 3-to-1 vote (Commissioner Allison Herren Lee dissenting). The amendments modernize the regulatory framework and alleviate some of the burdens faced by companies in assembling required financial statements with respect to acquisitions and dispositions.

Regulation S-X Rule 3-05 establishes the basic requirement to provide financial statements of businesses that have been or are to be acquired, including audited annual and unaudited interim pre-acquisition financial statements. Whether acquiree financial statements are required and the number of years of financial statements to be provided are determined by the “significance” of such business to the registrant based on any one of three significance tests set forth in the definition of “significant subsidiary” in Regulation S-X Rule 1-02(w). Relatedly, Regulation S-X Article 11 requires pro forma financial information for certain acquisitions and dispositions, which is intended to show how the registrant’s historical financial statements may have been affected had the transaction occurred at an earlier time. Separate rules and forms relate to investment companies and real estate companies, which are affected by the amendments but not described in this post.

Among the most significant changes in the amendments are modifications to the three significance tests set out in Rule 1-02(w) (and Securities Act Rule 405 and Exchange Act Rule 12b-2), which are referenced in a number of contexts, including business acquisitions and dispositions:

- Investment Test. As a general matter, the current investment test compares the registrant’s and its subsidiaries’ investments in and advances to the tested entity to the total assets of the registrant and its subsidiaries in the registrant’s most recent annual financial statements required to be filed at or prior to the acquisition date. Among other revisions, the amendments make the following changes to this test:

- Aggregate Worldwide Market Value. In an acquisition or disposition context, the investments in and advances to the tested entity will now be compared to the aggregate worldwide market value of the registrant’s voting and non-voting common equity, when available. For such purpose, “aggregate worldwide market value” is the average of aggregate worldwide market value calculated daily for the last five trading days of the registrant’s most recently completed month ending prior to the earlier of the registrant’s announcement date or agreement date of the acquisition or disposition.

- Contingent Consideration. For purposes of the analysis, “investments in and advances to the tested entity” shall include the consideration transferred, less the registrant’s and its subsidiaries’ proportionate interest in the carrying value of assets transferred to the tested entity that will remain in the combined entity post-acquisition. In addition, “investments in” the tested entity include the fair value of contingent consideration (e.g., sales-based milestones or royalties) if required to be recognized in the registrant’s financial statements at fair value under U.S. GAAP or IFRS as of the acquisition date. Even if not required to be recognized under U.S. GAAP or IFRS, contingent consideration must be counted unless the likelihood of payment is remote.

- Income Test. As a general matter, the current income test compares the registrant’s and its subsidiaries’ equity in the tested entity’s income from continuing operations before income taxes (excluding any amounts attributable to any noncontrolling interests) to such income of the registrant and its subsidiaries for the most recently completed fiscal year. In addition to a handful of clarifications and simplifications, the amendments revise this test to provide as follows:

- Revenue Component. To reduce irregular results, particularly for registrants with nominal or break-even net income or loss in a recent fiscal year, the amendments add a new revenue component to the income test that also must be satisfied. The tested entity must meet both the revenue and net income components of the test to be “significant.” The revenue component compares the registrant’s and its subsidiaries’ proportionate share of the tested entity’s consolidated revenues from continuing operations (after intercompany eliminations) to such revenues of the registrant for the most recently completed fiscal year. The revenue component does not apply if either the registrant or the tested entity did not have material revenue in each of the two most recently completed fiscal years. For purposes of determining significance and the required financial statements to be provided pursuant to Rule 3-05, the registrant may use the lower of the percentage calculated using the revenue component or the net income component.

- Absolute Values. To avoid potential misinterpretations that could result from the inclusion of negative amounts in the computation (e.g., in loss scenarios), the net income portion of the test will be based on absolute values.

- Income Averaging. Currently, Computational Note 2 to Rule 1-02(w) provides that if a registrant’s income exclusive of amounts attributable to noncontrolling interests for the most recent fiscal year is at least 10% lower than the average of its income for the last five fiscal years, such average amount should be used for purposes of the calculation. The amendments make clear that if the new revenue test does not apply and the existing 10% threshold test in the Computational Note is triggered, then the income of the registrant for purposes of the income test shall be the average of the absolute value of such income for the last five fiscal years.

- Asset Test. The current asset test compares the registrant’s and its subsidiaries’ share of the tested entity’s assets (after intercompany eliminations) to the registrant’s and its subsidiaries’ total assets. The amendments to this test were modest and mostly clarified that total assets means “consolidated total assets.”

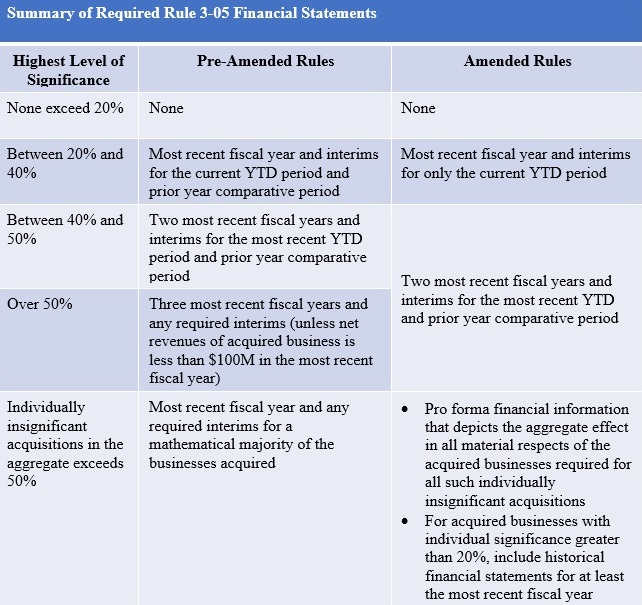

Critical to alleviating the burden on some registrants, the latest amendments also reduce the number of years of audited historical and unaudited interim financial statements that must be provided for acquired businesses under Rule 3-05. Under the new rules, no more than the two most recent fiscal years are required regardless of significance, as summarized in the following chart:

The amendments also include a number of other changes, some highlights of which include:

- Individually Insignificant Acquisitions. Eliminating the requirement to provide historical financial statements for individually insignificant acquisitions. Historical financial statements will be required only for businesses counted as “individually insignificant” when their individual significance exceeds the 20% threshold but such historical financials have not been filed yet because of an allowable grace period under Form 8-K Item 9.01 and Rule 3-05.

- Pro Forma Adjustments. Improving the relevance of information included in the pro forma financial information under Article 11. Some of the pro forma adjustment criteria include “transaction accounting adjustments” that only reflect required accounting to the transaction, “autonomous entity adjustments” for registrants that were formerly part of another entity to reflect the operations and financial position of the registrant on a standalone basis, and “management’s adjustments” for adjustments that enhance an understanding of the effects of a transaction that result from synergies and dis-synergies.

- Smaller Asset Acquisitions/Liability Assumptions. Permitting abbreviated financial statements if an acquired “business” meets a number of qualifying conditions, including that the total assets and total revenues (both after intercompany eliminations) of the acquired or to be acquired business constitute 20% or less of the seller and its subsidiaries as of the most recently completed fiscal year.

- Foreign Private Issuers/Foreign Businesses. Aligning potential disconnects between the basis of accounting to be used for Rule 3-05 financial statements by acquired businesses and foreign private issuers (FPIs). Notably, FPIs may reconcile Rule 3-05 financial statements of acquired “foreign businesses” that use home country GAAP to IFRS, rather than reconciling to U.S. GAAP. In addition, Rule 3-05 financial statements may be prepared under IFRS without reconciliation to U.S. GAAP if the acquired business would qualify as a FPI if it were a registrant.

- Measuring Significance on a Pro Forma Basis. Permitting the use of pro forma financial information to measure significance in filings that require Rule 3-05 financial statements where the registrant has filed (a) the Rule 3-05 financial statements for any such acquired business and (b) the pro forma financial information required by Article 11 for any such acquired or disposed business.

- Significance Threshold for Dispositions. Increasing the significance threshold from 10% to 20% for purposes of analyzing business dispositions under the pro forma financial statement requirements in Article 11.

- Post-Acquisition Presentation. No longer requiring separate acquired business financial statements once a business has been included in the registrant’s post-acquisition financial statements for nine months or a complete fiscal year, depending on significance, even in instances when the Rule 3-05 financial statements have been previously filed and the acquired business is of major significance to the registrant.

The amendments become effective January 1, 2021, and must be applied as of such time, even when evaluating the significance of acquisitions and dispositions consummated prior to January 1, 2021. Early compliance with the final amendments is permitted, provided that the final amendments are applied in their entirety at such earlier time.