On Friday, the Securities and Exchange Commission’s Division of Corporation Finance announced big changes in the internal structure of its disclosure program. While not a regular occurrence, such reorganizations happen periodically to reflect market developments and trends, including changes in numbers and types of reporting companies, new products, and new types of risks, among other things. The current realignment of the disclosure program, which became effective September 29, 2019, is intended to “promote collaboration, transparency and efficiency” as the Division carries out its “mission critical work to facilitate capital formation and protect investors.” Following the restructuring, the disclosure program staff in the Division work through one of four groups:

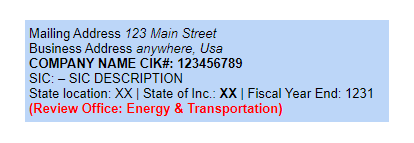

1. Disclosure Review Program. This group will continue the Division’s selective and required filing reviews, but now in accordance with the following seven industry focused offices (reduced from eleven), each of which will be led by an Office Chief who will be supported by a Senior Advisor. These are both newly-created positions and are being filled by a mixture of senior level lawyers and accountants in the Division. The Division will continue to assign companies and filings to review offices by their principal industry focus using SIC codes. The seven industry focused groups are:

- Energy & Transportation

- Finance

- Life Sciences

- Manufacturing

- Real Estate & Construction

- Technology

- Trade & Services

Companies can locate their reassigned offices at the top of the company’s EDGAR filing history:

Kyle Moffatt, the Division’s Chief Accountant, will lead the Disclosure Review Program and will stay in his role as the Division’s Chief Accountant.

To the extent practicable, Division staff members assigned to active filing reviews will complete those filing reviews regardless of the office to which they are assigned in the realignment.

2. Specialized Policy and Disclosure. This group will consist of the Division’s Offices of International Corporate Finance, Mergers and Acquisitions and Structured Finance, and it will continue to be overseen by Michele Anderson.

3. Office of Risk and Strategy. This group will provide filing review teams with guidance on “developing risks and evolving disclosures,” which could include things like the LIBOR transition. Shelly Luisi will continue to lead the group and will be joined by Cecilia Blye, Catherine Brown and Angela Crane.

4. Office of Assessment and Continuous Improvement. This is a new group, which will evaluate the effectiveness of the SEC’s disclosure review program. Cicely LaMothe will manage the group, and she will be joined by former Assistant Directors Barbara Jacobs and Amanda Ravitz and former Senior Assistant Chief Accountants Andrew Mew and Jim Rosenberg.

Updates to come as more information becomes available.