On December 1, 2020, Nasdaq filed a proposal with the SEC to adopt Rules 5605(f) and 5606 regarding board diversity and board composition disclosure, respectively. Nasdaq believes that these new rules, if approved by the SEC, will provide greater transparency to stakeholders and promote diversity within the board selection process.

Proposed Rule 5605(f) would require the board of directors of most Nasdaq-listed companies to:

- have at least one director who identifies as female, and at least one director who identifies as an unrepresented minority or LGBTQ+; or

- explain why the board does not have at least two diverse members who identify in these categories.

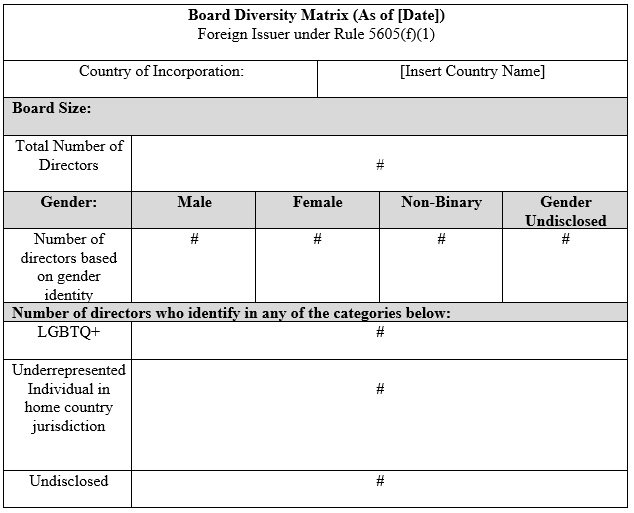

Smaller reporting companies and foreign issuers would be subject to slightly different requirements. Smaller reporting companies would be required to have at least one diverse director who identifies as female; however, the second diverse director may identify as female, LGBTQ+ or an underrepresented minority. Foreign issuers, a term that is broader than just foreign private issuers, would still be required to have at least one diverse director that identifies as female; however, the second diverse director may identify as female, LGBTQ+ or an underrepresented individual based on national, racial, ethnic, indigenous, cultural, religious or linguistic identity in the company’s home country jurisdiction.

If a company does not have two diverse directors, it must explain which of the general, foreign issuer or smaller reporting company requirements are applicable to its board and disclose why it does not have two diverse directors. The disclosure can be provided in the company’s annual meeting proxy statement or on its website.

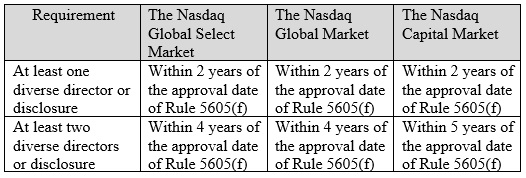

Companies would be required to implement this rule based on listing tier:

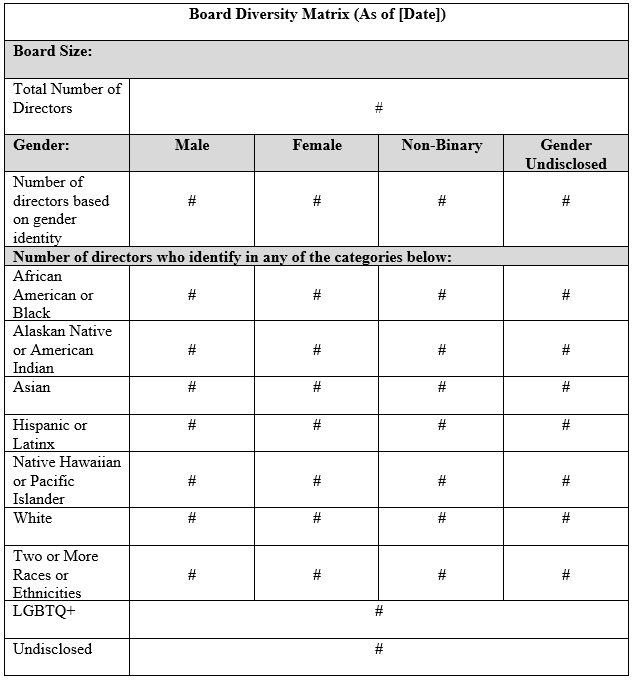

Proposed Rule 5606 would require companies to disclose board composition in their annual meeting proxy statements or on their website in the format below:

Definitions of the various categories of diversity are included in instructions proposed as part of Nasdaq’s rule filing. Nasdaq also issued a series of FAQs relating to the proposed rules.