On December 22, 2017, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 118 (SAB 118) to assist companies comply with applicable accounting rules regarding the impact of the 2017 Tax Cuts and Jobs Act, which was signed into law on the same day. The Act contains many changes that affect public companies, including changes in tax rates and business deductions and a mandatory deemed repatriation of certain foreign earnings and profits. Under accounting rules, the effects of these changes generally need to be reflected in the financial statements for the period that includes the date of enactment (i.e., the year ended December 31, 2017, for calendar year-end filers).

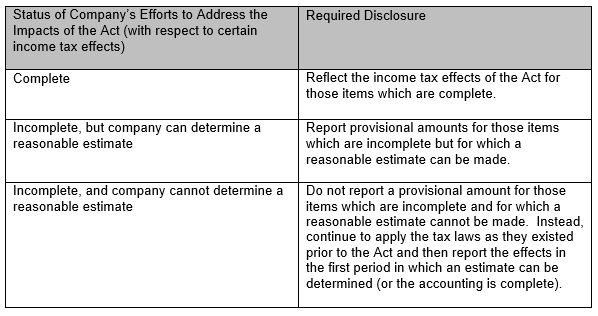

SAB 118 provides companies with up to a year to complete the disclosures required under the applicable accounting rules regarding changes prompted by the Act. Recognizing the possibility that a company’s accounting for certain effects of the Act (e.g., changes to deferred tax assets or valuation allowances) may not be complete by the time it issues its financial statements for the period that includes the enactment date, the SEC staff has provided the following guidance:

Where the accounting is incomplete, SAB 118 requires companies to provide the following additional disclosures:

- Qualitative disclosures of the income tax effects of the Act for which the accounting is incomplete;

- Disclosures of items reported as provisional amounts;

- Disclosures of existing current or deferred tax amounts for which the income tax effects of the Act have not been completed;

- The reason why the initial accounting is incomplete;

- The additional information that is needed to be obtained, prepared, or analyzed in order to complete the accounting requirements under ASC Topic 740 (Income Taxes);

- The nature and amount of any measurement period adjustments recognized during the reporting period;

- The effect of measurement period adjustments on the effective tax rate; and

- When the accounting for the income tax effects of the Act has been completed.

In addition, the SEC staff also issued Compliance and Disclosure Interpretation 110.02 (December 22, 2017), which indicates that the impact of the Act on deferred tax assets will generally not trigger a reporting obligation under Item 2.06 of Form 8-K for “material impairments.”

Audit committees may want to engage with their auditors and management teams to discuss the impact of the Act and the expected timing for addressing the impacts of the Act.